HEKA - Where Tech meets Brain Science

Heka is the first fund that invests in next-gen BrainTech in Europe and the United States.

Brain Capital

The world is increasingly relying on brain capital, where a premium is put on brain skills and brain health. Through its investments and support, HEKA contributes to strengthening and rebuilding of brain health.

The fund builds on the Brain Capital approach. The BrainTech startups in which Heka invests connect science and technology to bring bliss and resilience to people.

Supported solutions leverage scientific results in the fields of mental health and substance use, neurology, neuroscience, adolescence, education, the future of work, creativity and innovation, and brain performance, particularly in late life and early childhood.

Harnessing the wealth of biological data with AI

Innovative solutions are emerging thanks to new diagnostic tools, such as those resulting from identifying biomarkers that can now measure what impacts the brain.

Heka is dedicated to investing in innovations that harness the wealth of biological data related to the brain, integrating it with cutting-edge software and AI.

Our focus spans precision medicine, personalized treatments, and predictive strategies, fundamentally changing the paradigm of medical care and addressing critical health challenges.

The diversity of fields of intervention for HEKA is immense as startups are multiplying on the subject.

A portfolio of 20+ BrainTech leaders

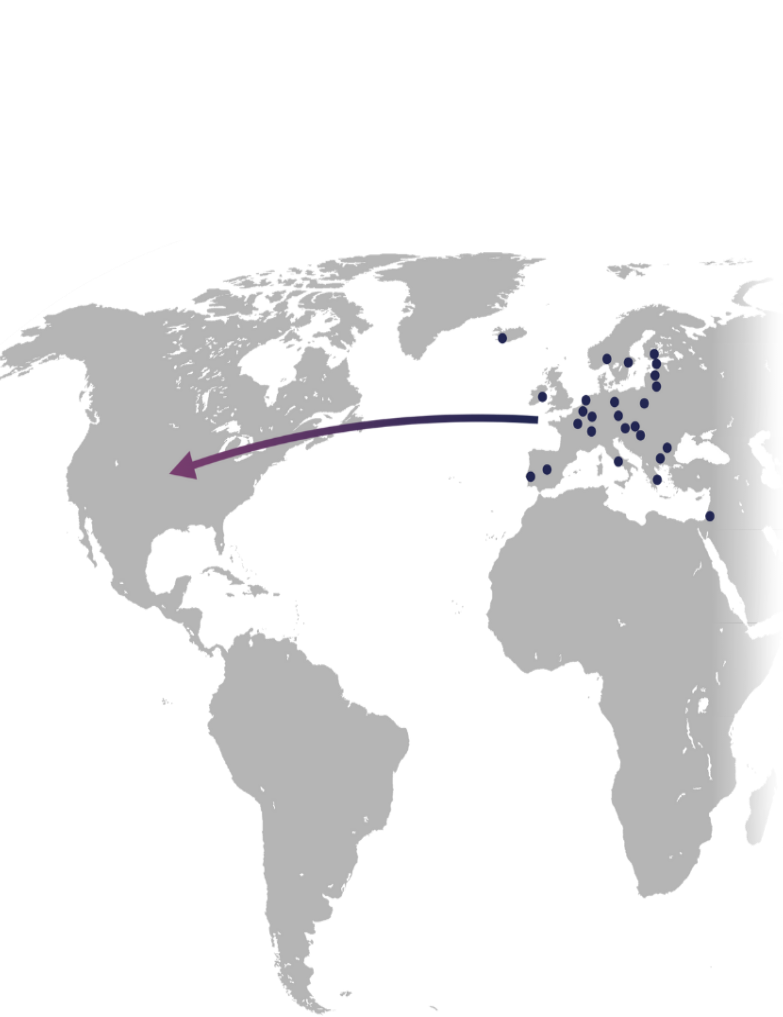

HEKA has the ambition to finance and build global Brain Capital Startup champions.

The startups will be sourced in the European Union (70%), Switzerland, Norway, Israel (5%), and the USA (25%). The portfolio will be built over five years and will consist of 20 to 25 companies.

The fund will invest on all topics of the BrainTech sector. HEKA will make the initial investment at Seed and Series A stages, and will continue supporting the startups through selective follow-ons.

Our ambition is to help our portfolio companies expand to the USA, thanks to our dedicated team in Palo Alto, our wide US network and our Road to the USA refined method.

Interested in investing in HEKA?

A unique scientific partnership with the FondaMental Foundation

HEKA relies on a unique investment process leveraging the finest from both scientific rigor and investment best practices.

The partnership with the FondaMental Foundation opens access to a wealth of scientific expertise for Heka's team and its community. Scientific experts will inform investment decisions and help support start-ups. The quality of the scientific evaluation is unmatched for a VC fund.

Heka's strategic orientations will be discussed by a supervisory board involving exceptional members, each of them expert in a specific field - Science, Industry, Policy, and Innovation.

BrainTech Content

Our team regularly shares updates on our portfolio companies and in-depth studies into sub-sectors we are actively exploring.

- Study: Brain and nutrition - the new challenges for innovation

- Study: Brain-Computer Interface - An Investor Perspective

- Study: Psychedelics - An Investor Perspective

- Study: The SleepTech Industry: an Investor Perspective

- Study: Skills enhancement startups: an investor point of view

- Study: Exploring Opportunities in the Nordic Countries

Interested in BrainTech content? Join the HEKA newsletter.

HEKA is an impact fund built on purpose to increase positive externalities in the Brain Capital area

and an ESG sustainable investing product classified as "Article 9" under the European SFDR regulations.

This comes with strong commitments

Sustainable Development Goal - SDG 3.4: Good Health and well-being

Over 80% of invested companies’s revenues will contribute to Good Health and well-being, as defined within United Nations’ Sustainable Development Goals:

“By 2030, reduce by one third premature mortality from non-communicable diseases through prevention and treatment and promote mental health and well-being.”

The three main non-communicable diseases are dementia, stroke and depression.

Delivering social impact

✔ Thorough ESG assessment through a dedicated scoring tool.

✔ Principal Adverse Impacts and Do No Significant Harm principles

of the OECD and the UN

✔ Discussion with target companies around relevant KPIs and

post-closing ESG commitments.

✔ Collection of extra-financial data, KPIs monitoring, SFDR reporting.

✔ Responsible shareholder practices and support to our founders on

ESG & Impact areas.